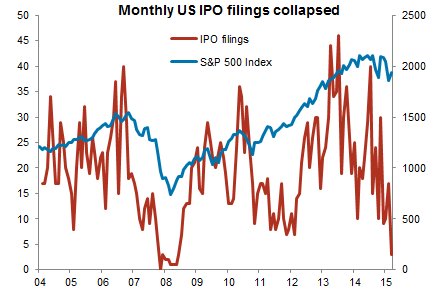

IPO filings. month by month, when graphed as above yield a very volatile line, much more volatile than the S&P 500 index represented by the overlain blue curve there.

Nonetheless, the recent collapse in the quantity of IPO filings by United States companies is remarkable. As you see, in late 2007 and in the early months of 2008 the IPO market almost disappeared entirely. But the line was headed back up BEFORE the worst of the crisis. The worst, you may remember, began with the bankruptcy of Lehman and the sale of Merrill Lynch for a fire sale price. That was in mid September 2008, during the upswing in IPO rates you see in the middle of the graph.

Simplifying greatly, there was a high in 2010, a month with 35 IPOs, and a lot of lows later that year and throughout 2011. Then a recovery getting above 40 IPOs per month a couple of times in 2013 and again in 2014.

Since then, though ... collapse, fairly consistently month to month. ONLY THREE IPO FILINGS IN FEBRUARY. We're back down to those early 2008 levels.

This is very significant, because public offerings have long been a key engine of growth for a wide range of businesses, and a step in their maturation. The IPO means that an enterprise has left the world of private equity and entered the world of the public listing, and that is accordingly the moment of pay-out and reward for those who successfully invested during the hardscrabble private-equity days.

The financing system is changing, and not for the better

The reason for this collapse, I can't help but believe, has a lot to do with the dysfunctions of market structure we've seen building up since the GFC. The arm's race of high frequency traders, the literally robotic nature of much trading, so that human discretion disappears from the picture for long periods of time, the flash crashes and mega-glitches that arise in this situation. The world of public listing no longer looks like the land of promise.

We should all be worried about this.

Simplifying greatly, there was a high in 2010, a month with 35 IPOs, and a lot of lows later that year and throughout 2011. Then a recovery getting above 40 IPOs per month a couple of times in 2013 and again in 2014.

Since then, though ... collapse, fairly consistently month to month. ONLY THREE IPO FILINGS IN FEBRUARY. We're back down to those early 2008 levels.

This is very significant, because public offerings have long been a key engine of growth for a wide range of businesses, and a step in their maturation. The IPO means that an enterprise has left the world of private equity and entered the world of the public listing, and that is accordingly the moment of pay-out and reward for those who successfully invested during the hardscrabble private-equity days.

The financing system is changing, and not for the better

The reason for this collapse, I can't help but believe, has a lot to do with the dysfunctions of market structure we've seen building up since the GFC. The arm's race of high frequency traders, the literally robotic nature of much trading, so that human discretion disappears from the picture for long periods of time, the flash crashes and mega-glitches that arise in this situation. The world of public listing no longer looks like the land of promise.

We should all be worried about this.

Comments

Post a Comment